Excellent Ideas For Selecting Refinansiere Boliglån

Wiki Article

What are the dates and times when credit-worthy loans secured?

Secured Loans: Secured loans are secured by collateral such as an automobile or a property. If the borrower is in default, the lender can confiscate the collateral in order to recuperate their losses. As an example secured consumer loans can be home equity loans or a auto loans.

Unsecured Loans- Unsecured loans don't require collateral, and are depending on the creditworthiness of the borrower and capability to repay. Personal loans, credit cards, and some student loans are in this category. Unsecured debts typically have greater interest rates than secured loans due to the increased danger for lenders.

The choice between secured and unsecure loans is contingent on factors such as credit history as well as the amount required and the borrower's comfort with the collateral. Unsecured loans are generally used for small amounts or when collateral is not accessible or needed. Larger loans or loans with higher interest rates typically require collateral. Follow the best Søk Forbrukslån for blog tips including nedbetalingstid boliglån, beste lån, lav rente, beregne rente, refinansiere forbruksgjeld, låne rente, boliglån rente kalkulator, nominell rente, søknad boliglån, raske lån and more.

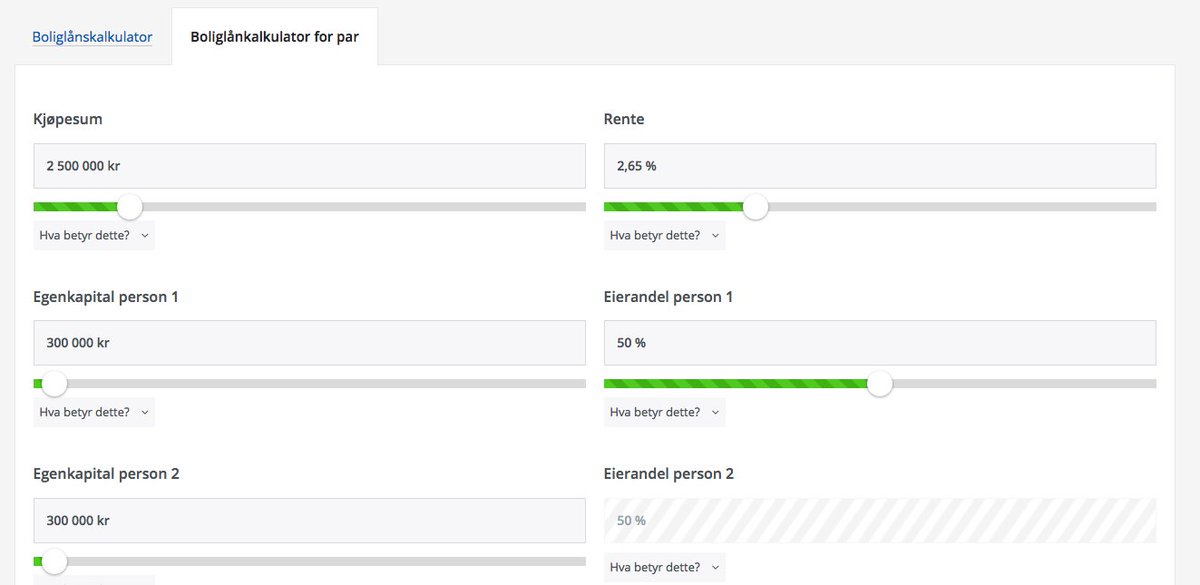

What Is An Mortgage Calculator And How Can It Be Useful And Accurate?

It assists people in planning their housing expenses and estimates affordability. It can help individuals to plan and budget their housing expenses. Be aware of these elements:

Estimation for Monthly Payments: Mortgage calculators can provide an estimate of the monthly payments depending on the data input. These calculators factor in principal, interest, and could include other factors such as homeowners insurance and property taxes.

Accuracy of Information - The precision of the calculator relies on the precision of the input information. The results calculated could be inaccurate if have provided inaccurate information, for example the amount of loan or the interest rate.

Limitations on scope- Most mortgage calculators are just estimates. They don't take into account each financial aspect, nor fluctuating factors such as changes in interest rates, insurance or property taxes.

Educational Tool - They are useful tools for education that permit the user to play with different scenarios. Users can modify variables so they know how changes to conditions for loans or the down payment impact monthly expenses and overall expenses.

Mortgage calculators are an excellent tool to compare different mortgage terms and options. This lets you make an informed decision on the best mortgage options.

Consultation with a professional- While mortgage calculators can provide useful estimates, it's best to talk with mortgage brokers or financial advisors, lenders, or financial planners to gain an understanding of the loan options available, eligibility criteria and your specific financial situation.

Mortgage calculators can be an excellent place to start making estimates of mortgage payments as well as exploring different possibilities. Engaging with experts in finance is the most effective way to obtain exact and precise details, particularly regarding the approval of loans and rates. Check out the top rated Boliglånskalkulator for blog advice including refinansiere kredittgjeld, lånekalkulator forbrukslån, lav rente lån, refinansiering av gjeld med betalingsanmerkning, refinansiere lån med lav rente, refinansiering lavest rente, lånekalkulator hvor mye kan jeg låne, rentekalkulator lån, boliglån rente, lån rente and more.

What Is Refinance House Loan? How Do I Get Accepted To Get One Of These Loans?

A refinance home mortgage an unpaid loan to replace the existing mortgage for a home. A lot of people refinance their home to get lower interest rate, modify the terms of their loan, or gain access to the equity in their homes. A refinance home mortgage approval is determined by a variety of factors. The lenders determine your creditworthiness by your credit score and past history. Credit scores are usually associated with better rate of interest and loan terms.

Check for Income and Employment Lenders verify your income stability along with your employment history and creditworthiness to determine whether you are able to repay the loan.

Equity in your home The equity you hold in your home is crucial. The majority of lenders require you have a certain amount in equity before they approve your refinance. Equity is calculated by comparing the property's value to the remaining mortgage balance.

Loan-toValue (LTV), Ratio: The proportion of your home's value you loan is called the LTV. Lenders prefer LTV ratios that are less than 80% as they represent a lower risk.

Appraisal - A property appraisal is often required to determine the present market value of a home. The lenders will make use of it to determine the value of the home with the loan amount.

Debt-to Income (DTI Ratio) (DTI Ratio) Lenders evaluate the DTI ratio by the amount of your monthly debt payments to your income per month. A lower DTI ratio demonstrates your ability to manage additional debt.

Documentation - Collect all required documentation including taxes, pay stubs, and bank statements. Lenders often look at this data to determine your financial standing.

Purpose Of Refinance. Be clear about the reason for refinancing. This could be to lower the monthly payments or to alter the term of your loan.

Each lender has its individual requirements. If you evaluate different offers, you can find the best deal. Additionally, understanding the expenses associated with refinancing, like fees and closing costs, is vital in evaluating the overall benefit of a refinance. Read the top rated Refinansiere Boliglån for blog examples including lån uten sikkerhet med betalingsanmerkning, forbruks lån, forbrukslån refinansiering, flytte boliglånet, lån bank, flytte boliglånet, lån bank, refinansiering lavest rente, lån med inkasso, bank norge and more.